Winning my Second Hackathon: Scaling Web3 Hackathon and the Orderly Network

Key takeaways from my experience winning the Orderly bounty for the Scaling Web3 Hackathon

Captains Log | Funding Rate Arbitrage

The Arbitrage Maneuver

In this spacetime adventure, we navigate the astronomical world of Crypto Perpetual Futures. The dark energy that lurks in this realm creates arbitrage opportunities for a cryptonaut to mine some celestial resources. Thus bringing us to our latest mission: The Scaling Web3 Hackathon, where we set our sights on a challenging yet rewarding task: funding rate arbitrage across perpetual DEX's, and the victory that followed...

Mission Overview: Funding Rate Arbitrage

Concept and Strategy

Funding rate arbitrage exploits the differences in funding rates between long and short positions across various DEXs. In perpetual futures markets, funding rates ensure the contract price remains close to the spot price. Disparities in these rates across different platforms create opportunities for arbitrage.

Core Mechanics

-

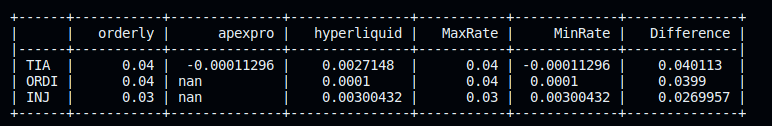

Funding Rate Comparison

I developed a program to fetch and compare funding rates from multiple DEXs, including Orderly, Hyperliquid, and ApexPro.

-

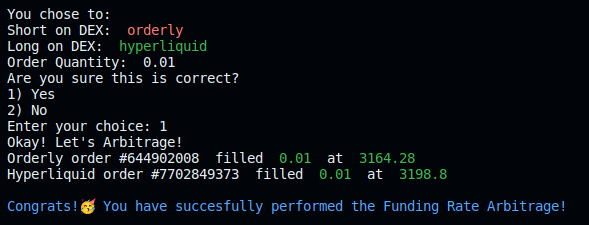

Arbitrage Execution

By identifying DEXs with the highest and lowest funding rates, we strategically placed short and long positions to profit from the rate differences. This involved shorting on a DEX with a higher funding rate and longing on one with a lower rate.

-

Automation and Monitoring

Our solution included a user-friendly interface for monitoring balances, open positions, and executing arbitrage strategies efficiently.

Technical Implementation

Backend Development

The backend was developed to manage the core functionalities of the arbitrage strategy.

-

Funding Rate Retrieval

Implemented APIs to fetch current funding rates from supported DEXs.

-

Arbitrage Strategy Execution

Designed algorithms to identify profitable arbitrage opportunities and execute trades accordingly.

-

Order Management

Built functionalities to manage open positions, cancel orders, and track USDC balances across exchanges.

Project Structure

-

main.py

Entry point for the application, providing an interface for users to interact with the arbitrage features.

-

DEX Implementations

Separate modules for each supported DEX, ensuring modularity and ease of extension.

-

Arbitrage Strategies

Core logic for comparing funding rates and executing trades.

Frontend Interface

While the primary focus was on backend functionalities, we also developed a simple, intuitive frontend to enhance user interaction.

-

View Balances

Users can view their USDC balances across all supported DEXs.

-

Manage Positions

Interface for viewing and closing open positions, as well as canceling open orders.

-

Execute Strategies

Users can initiate the funding rate arbitrage strategy, providing details such as asset symbol, DEX selection, and order quantity.

Key Features and Enhancements

-

Modular Design

The program's modular structure allows for easy integration of additional DEXs and customization of arbitrage strategies.

-

Real-Time Data

Continuously fetches and updates funding rates, ensuring timely and accurate arbitrage opportunities.

- User-Friendly Interface Simplifies the process of managing positions and executing arbitrage strategies, making it accessible even for those new to arbitrage trading.

Victory and Reflection

Wooh! What a cosmological journey down the ever expansion of space in the Crypto Futures world. Quite the quantum entanglement that can be. Winning the Orderly Network bounty at the Scaling Web3 Hackathon was a stellar achievement. The project demonstrated the ability to blend complex financial strategies with robust blockchain development.

As we look forward to future missions, this victory serves as a testament to proper space exploration. The blockchain universe is vast, and with each project, we push into a new frontier. Stay tuned for more adventures from the blockchain cosmos!